Are you still waiting for the crypto revolution to begin? Newsflash: it’s already happening! Millions of people flock to the crypto market daily to test their skills and luck, and many come out victorious. If you wish to join them, it’s high time you learned how to buy crypto on Binance.

This easy-to-follow guide introduces you to Binance, the world’s number one cryptocurrency exchange. Moreover, we’ll also provide an overview of cryptocurrencies that’s perfect for anyone without prior experience with crypto. But most importantly, we’ll show you just how easy it is to use Binance and start your crypto journey.

Topics you can expect to be discussed in this guide include:

- An overview of Binance and its services;

- An introduction to cryptocurrencies and blockchain technology;

- Reasons why people buy crypto;

- A step-by-step tutorial on how to buy cryptocurrencies on Binance;

- Answers to questions people frequently ask about buying crypto on Binance.

Are you ready to dip your toes into the exciting realm of cryptocurrencies? We bet you are! So, grab your drink of choice, and let’s begin.

Who Is This Guide for?

We created this guide for complete beginners. It’ll be helpful for people who have never used Binance and even those who have never dabbled in the crypto market. For this reason, we have also provided some background information about Binance as a company and the cryptocurrency industry in general.

The following guide is perfect for anyone looking to buy crypto on Binance. Whether you plan to simply hold your crypto investments or use your coins to trade, this guide will show you how to use fiat currency to purchase crypto.

If you’re already familiar with the cryptocurrency market and Binance, we recommend skipping ahead to the step-by-step guide section.

What Is Binance?

Binance is arguably the most well-known cryptocurrency exchange in the world. It has been around for many years and is one of the most recognisable names in crypto. In fact, its own cryptocurrency — the Build and Build coin (previously known as ‘Binance coin’) — is the fifth most important token by market cap.

The History of Binance

Binance has its origins in China, where it was founded in 2017 by Changpeng Zhao, who still serves as its CEO.

Zhao, whose background is in computer science, had worked in the trading industry before launching this project. He has developed trading software for the Tokyo Stock Exchange and Bloomberg, among other clients.

He was also associated with Blockchain.info and OKCoin in the early 2010s. Those projects marked his first steps in the cryptocurrency world.

Zhao launched Binance in the summer of 2017 to immediate success. It only took a few months for the platform to become the most widely used cryptocurrency exchange, a title it still holds.

Due to China’s aggressive stance on cryptocurrencies, Binance changed headquarters a few times. It was briefly based in Japan before moving to the Cayman Islands, where it is currently registered.

What’s Binance Used for?

As an exchange, the primary purpose of Binance is to allow clients to turn one cryptocurrency into another. But in practical terms, users can do a lot more than that. Let’s look at the main services Binance offers.

Buying Crypto

People can open Binance accounts to purchase cryptocurrencies. For example, if you want to own bitcoins or ether tokens without mining cryptocurrencies, you can simply buy them on Binance.

Naturally, the company offers a crypto wallet, where you can keep all tokens you buy. So, if you are trying to employ a buy-and-hold strategy for long-term investments, you can easily do that with Binance.

Exchanging Crypto

This function is the most obvious one, knowing that Binance is one of the best crypto exchanges in the world. It refers to all transactions that convert one cryptocurrency into another.

For example, let’s assume that you have a Bitcoin wallet with a fair amount of BTC, and you want to use a particular dApp to do something. Most decentralised apps run on Ethereum, so let’s say that’s where you need to go. Bitcoin doesn’t support smart contracts natively, so you cannot use it directly.

For this reason, you need to convert some of your bitcoins into ether. Then you can use that ETH to access that dApp you wanted.

In this case, Binance can help you instantly turn your bitcoins into ether. You can also turn it back into BTC when you finish playing with DeFi solutions.

In fact, Binance supports hundreds of cryptocurrencies. You’ll be hard-pressed to find an exchange you can’t do on its network.

Moreover, Binance also supports peer-to-peer crypto exchanges. In P2P, you trade cryptocurrency with another user directly.

Trading Crypto

Besides buying and exchanging cryptocurrency, the platform supports spot trading too. In that sense, the company functions like a crypto broker.

Spot trading bears similarities to exchanging assets since it also consists of buying and selling crypto. However, rather than doing it for a practical purpose, such as accessing a service on a different blockchain, spot trading is a way to profit.

Like trading stocks or currency pairs, spot trading crypto can be a potentially profitable activity. Traders profit from the price changes of crypto assets and considering how volatile the market is, there are many opportunities to benefit from the price fluctuations.

Not every Binance user is there to trade. But it’s an added benefit to know you can also do this from your Binance account.

Binance versus Crypto Brokers

Cryptocurrency exchange is Binance’s specialty, the main service it’s known for. So, if you’re planning to trade crypto, you might think a dedicated crypto broker would be better than Binance. Is there any truth to that?

If you only plan to trade cryptocurrency, it doesn’t make much of a difference. Both Binance and most crypto brokers have similar offerings. Their trading platforms also provide similar options and data.

The most significant difference between Binance and other brokers becomes evident if you want to trade more than crypto. Most brokers also allow you to invest in currency pairs, stocks, options, futures, etc. Meanwhile, Binance only specialises in crypto, so that you won’t find any other asset class there.

Of course, there may be other differences. For instance, the spread between the bid and ask prices, trading fees, margin trading requirements, or the commission for opening or closing trade orders. But at that point, you are simply comparing the trading conditions of Binance and other brokers. That’s a big topic that we won’t cover in this guide but you can find more information about it on our platform reviews page.

What Are Cryptocurrencies?

Cryptocurrencies offer an alternative to traditional currency (fiat money). Their main goal is to decentralise money, i.e., take control away from formal institutions such as governments and central banks and put it in the hands of the people instead.

Unlike fiat currencies, crypto does not have a regulatory body. Instead, the people using the network make decisions about tokens in circulation, mining rewards, validation protocols, etc. Each blockchain network has its own rules and consensus mechanisms. Still, they all strive to leave power in the hands of people as a collective instead of keeping it centralised and focused on one person or organisation.

The word ‘crypto’ comes from cryptography, or encoding information, usually to protect it. All transaction information and usually data about the entities participating is hidden in code when using cryptocurrencies.

But all of that encryption and privacy-oriented processing would be impossible without blockchain technology. Indeed, that is a term often thrown about when talking about cryptocurrencies, yet many people still don’t understand it well. So, let’s look at what blockchains are and how they tie to cryptocurrencies.

Blockchain Technology 101

If you’re a complete beginner, you might think blockchains are complicated. In fact, they are pretty simple — everything you need to know is already in the name.

A blockchain is literally a chain of blocks of information. Let’s use the Bitcoin blockchain as an example.

Every computer with Bitcoin mining software installed is part of the blockchain network. The latter is made possible by the total computing power of all users.

The Bitcoin network was created to serve specifically as a digital ledger. That means the blocks of data contain details about transactions — who owns what, who sold or bought what from whom, etc. But all of that info is encrypted.

Each block of data has a unique code called a hash. When a new transaction happens, a new block with a different hash is added to the chain. However, the numbering of the blocks is sequential, so there is a clear chronological order to all blocks in the chain.

As new blocks are added very fast, computers in the network automatically validate the info on the blockchain. In other words, all computers have a history of events on the blockchain and are constantly checking that everyone else has the same version or chronology.

If someone tries to cheat and add a block that’s inconsistent with the rest of the blockchain, others will catch it and refuse to add it to the blockchain. That’s why validation is so important.

Nevertheless, validation is an energy-consuming process. That’s why Satoshi Nakamoto created Bitcoin, the cryptocurrency — to reward people for participating in the validation process. We call ‘crypto mining’ the issuance and distribution of tokens as a reward for keeping the network safe.

Types of Cryptocurrencies

In the example above, we used Bitcoin because it’s the first and most famous crypto coin. However, hundreds of others have appeared since its inception.

What’s more, they differ significantly from one another. In fact, there are several broad categories of cryptocurrencies. Understanding them might help determine what asset you wish to buy or trade. So, let’s look at some of the main terms and categories you’d encounter in the crypto world.

Coins

Generally speaking, a coin is any cryptocurrency running on its own blockchain. For example, Bitcoin and Ethereum each have their own networks. As a result, Bitcoin (BTC) and Ether (ETH) are cryptocurrency coins.

Tokens

Tokens are the native cryptocurrency of networks that run on a blockchain that isn’t their own. A common example is any ERC-20 token, for instance, the Basic Attention Token (BAT). All of these tokens run on the Ethereum blockchain.

Another way to think of tokens is as programmes, a set of codes to facilitate the use of smart contracts. Thus, developers usually create new tokens to bring new utility to a blockchain. They don’t strive to compete with crypto coins like Bitcoin or Ethereum, which can serve as a store of value.

This category is quite diverse. Tokens can be further divided into categories based on their primary use such as utility, governance, exchange, NFTs, etc.

Stablecoins are one of the most popular and confusing sub-categories of tokens. Yes, they are referred to as ‘coins,’ but they are tokens by design. Stablecoins are a set of cryptocurrencies whose value is pegged to another asset. For example, they may track the US dollar, the euro, crude oil, gold, etc. By tying their value to a real-world asset, stablecoins have very low volatility compared to all other cryptocurrencies.

Altcoins

Altcoins are not altogether separate from coins and tokens. Instead, the term appeared to differentiate Bitcoin from all other cryptocurrencies that showed up later. Essentially, any cryptocurrency that is an alternative to Bitcoin is an altcoin. That includes some coins, like Ethereum, and all tokens.

The Top 10 Cryptocurrencies

Now that you have some background knowledge of crypto, you might be wondering what the most successful coins and tokens are. Naturally, Bitcoin leads the charge, but what are some other popular assets?

Here are the top ten cryptocurrencies based on market capitalisation, according to CoinMarketCap:

- Bitcoin (BTC) — $357 billion

- Ethereum (ETH) — $154 billion

- XRP (XRP) — $20 billion

- Cardano (ADA) — $15 billion

- Polygon (MATIC) — $6 billion

- Shiba Inu (SHIB) — $5.7 billion

- Cosmos (ATOM) — $3.9 billion

- Ethereum Classic (ETC) — $3.8 billion

- Chainlink (LINK) — $3.3 billion

- NEAR Protocol (NEAR) — $2.9 billion

This data is accurate as of September 22, 2022. Based on price fluctuations, the market cap of any cryptocurrency may be different at the time when you are reading this guide.

Why Buy Crypto?

If you’re reading this guide, you probably already have a reason why you’re interested in buying cryptocurrency. But if you don’t, let’s look at the main factors motivating people to invest in the crypto market.

To start off, everyone has heard of crypto being profitable. So, in very general terms, you could say that the desire to earn money is what makes people buy crypto.

You might not know that there is more than one way to do that. Here are some different approaches to buying cryptocurrency.

Buy-and-Hold Strategies

This is perhaps the simplest way of making a profit from crypto coins. However, this doesn’t imply it’s easy.

Buying and holding a cryptocurrency is a form of long-term investment. It boils down to purchasing crypto and keeping it until its value significantly increases. The goal is to sell it someday when it is worth much more than it was when you bought it.

This type of investment sounds familiar because it’s essentially the same as buying stocks or bonds.

Advantages

- You don’t have to check on your investment every day.

- You don’t need expert trading skills.

- You can potentially get a very high return on your investment someday.

Disadvantages

- This method takes an unknown (usually long) time to produce favourable results.

- Your invested funds might stay ‘locked’ in this position for a long time.

- No one can predict the future and promise you that the wait will be worthwhile.

Store-of-Value

Store-of-value investments are similar to holding an asset. The same desire to see the value of what you bought increase over time is your guiding factor here.

Nevertheless, where store-of-value differs is that the investor might never plan to sell the asset. Like investing in gold or expensive art, using anything as store-of-value makes it part of your overall wealth.

It’s common for people to hold onto such assets for a lifetime and pass them down to their family members as part of their inheritance. But considering the novelty of cryptocurrencies, we haven’t seen anyone do that yet. Crypto simply hasn’t been around long enough to prove it can successfully compete with more traditional store of value assets.

Advantages

- You don’t have to do anything besides buying cryptocurrency.

- You don’t need any special skills.

Disadvantages

- It may require a more substantial initial investment.

- Your wealth might decrease over time if the crypto token you bought performs poorly.

Crypto CFD Trading

Trading cryptocurrency offers a way to earn money without ever owning the underlying asset. Crypto CFDs are tradable assets where you speculate about how the value of a cryptocurrency might change in a given period of time.

Crypto trading includes the repeated buying and selling of crypto tokens. Traders profit from the difference between the bid and ask prices. Their mantra is “buy low, sell high,” and that’s what all trading strategies come down to. For example, if you buy something for $1 and sell it for $1.50, your profit is $0.50.

To trade crypto CFDs, you need a broker. Luckily, Binance acts as one if you use its spot trading feature.

Advantages

- You can open many positions on different crypto coins with a relatively small budget.

- There are many different strategies you can use.

- Trading can be fast-paced and yield daily profits when done right.

Disadvantages

- You need good trading skills to succeed, so it’s best for advanced users.

- You have to keep an eye on your open positions often (depending on your strategy).

- The high volatility of cryptocurrencies can betray you and cause you to lose money.

Portfolio Diversification

Some people buy cryptocurrency without having the slightest interest in it. Yes, you read that correctly! Regardless of the crypto market’s promise, some investors don’t care for it.

The only reason you’d see such people buy crypto is to diversify their investment portfolios. Indeed, financial experts recommend investing in different assets to minimise potential losses.

Diversification is a risk-management strategy that helps ensure your portfolio can be successful regardless of how the market conditions change. Not all factors affect all assets equally, after all.

For example, let’s say there is negative news about the Federal Reserve. Perhaps there has been another scandal about insider trading. If you’ve only invested in the US dollar, this news will strongly impact you.

But cryptocurrencies don’t care about the Federal Reserve, and their value will not be affected. In fact, if the US dollar decreases in value, cryptos that are quoted in USD might experience a price increase to compensate.

So if you had a backup investment in crypto, the overall balance of your portfolio might be fine even amidst such negative news. That’s why some people buy crypto — to protect themselves against losses from other investments.

Note: Regardless of how or why you buy cryptocurrencies, remember that all investments carry risks. The crypto market is highly volatile and unpredictable. Always plan your investments carefully, mind the risks, and do your own research first.

Buying Crypto on Binance: a Practical Guide

Alright, now you know the crypto market, and you’re ready to invest in cryptocurrencies. This section will show you exactly how to buy cryptocurrencies on Binance.

Don’t worry — none of this is complicated! Simply follow the steps we outline below, and you’re good to go.

Step 1: Create a Binance Account

Head over to the Binance website and press Register in the upper right corner.

The website will then offer you several options to create a crypto exchange account. For example, you can use an existing Google or Apple login or create a dedicated Binance one with your email or phone number. Choose whatever is the most suitable for you and follow the on-screen instructions to complete your registration.

Step 2: Log into Your Binance Account

Log into your Binance account using the credentials you just created. The Log In button is also in the upper right corner, on the left of Register.

Step 3: Go to ‘Buy Now.’

Now you’re ready to start buying crypto. You can do this by clicking on Buy Now in the upper left corner of the webpage.

Notice that if you hover over it with the mouse, a dropdown menu with payment options appears. These are the methods at your disposal for buying crypto. You can also adjust the base currency the website suggests.

Step 4: Choose What Crypto to Buy

The most popular cryptocurrencies will show up in the dropdown menu when you start buying. You can also use the search bar to quickly find the token you’re looking for.

Step 5: Set How Much You Want to Buy

Let’s say you want to buy Bitcoin and use the euro as your base currency. Here you need to specify how much euro you wish to spend. Binance will automatically calculate how much Bitcoin you’d get for that sum (you can see it below the field where you can type).

If you click in the upper right corner (the EUR symbol), you can change the base currency for the transaction. Bear in mind that if you use the same currency as your bank account or credit card, you can save money you’d otherwise waste on conversion fees.

Step 6: Choose a Payment Method

Because we went with the ‘buy crypto via card’ option at the beginning, here we can see a list of credit and debit cards we have saved on our account.

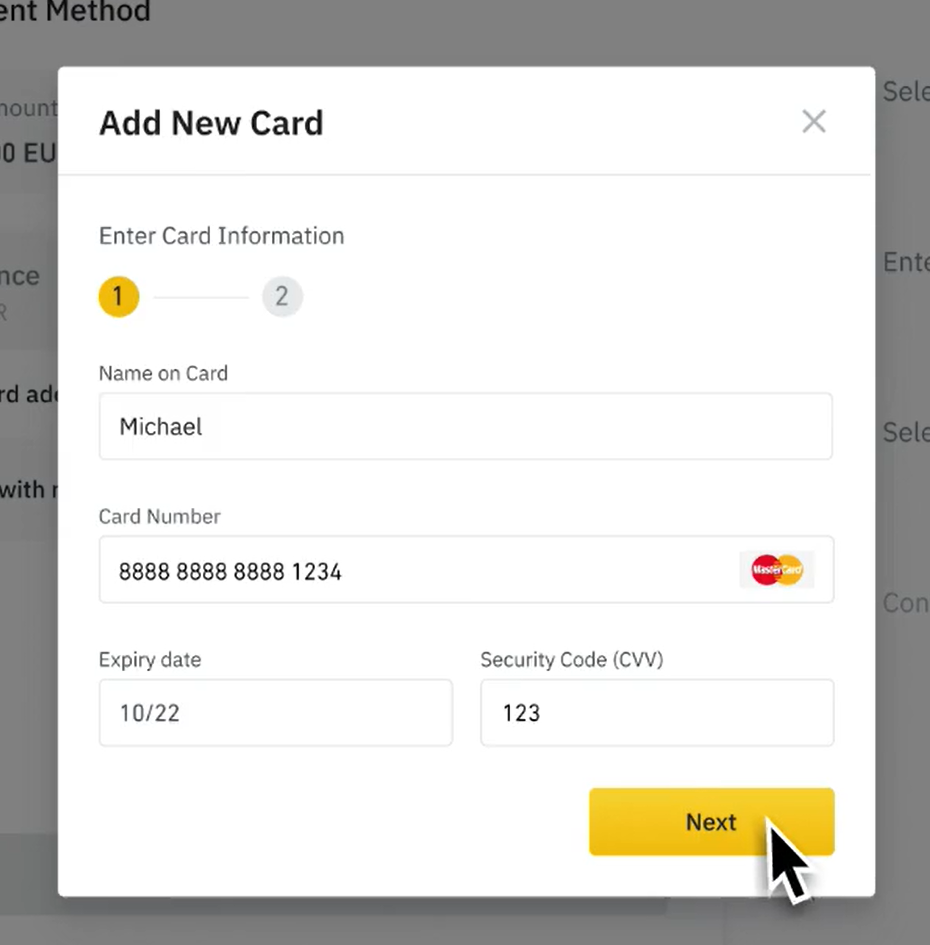

If it is your first time using Binance to buy crypto, you have to click on ‘Add new card.’

Then, fill in your card information and press Next.

Add your billing address and choose Add Card to save it to your account.

Later, you can go to ‘Manage cards’ to add, change, or remove a card from your account.

Notice the checkmark next to one of our cards. That’s the selected payment method.

Alternatively, you can switch to the Fiat Balance or P2P tabs for more payment options. Note that Fiat Balance might not be available in your region.

If it is, you’d need to deposit money to your Binance account in advance before you can buy cryptocurrency. Otherwise, this window will tell you your balance is not enough to complete the transaction.

With the correct method selected (look for the checkmark), press Continue.

Step 7: Confirm Your Order Quickly

In the next window, you’ll see an overview of your transaction. You will only have one minute to confirm it, or else it will time out, and you’d have to start again.

Press Confirm when you’re ready.

Step 8: Finalise Order via Your Chosen Payment System

You might need to complete additional steps depending on how you have decided to pay for your crypto. For example, when using a credit or debit card, Binance may ask you to complete your 3D verification. This extra step ensures that nobody has stolen your card and is trying to use it instead of you.

Step 9: You’re Ready!

If you’ve done all the steps correctly, Binance will let you know your transaction was successful. You can select Go to Wallet to see the purchased crypto in your account.

Now you can use your crypto however you wish! Perhaps you’re holding onto it in hopes of seeing its price grow over time. Or maybe you intend to use it in spot trading? It’s all up to you!

You can also watch this guide in video format here:

Frequently Asked Questions About Buying Crypto on Binance

Even with our detailed guide on buying cryptocurrency, we know you might still have questions. Here are some of the things people most frequently ask about buying crypto on Binance.

Is Binance a Good Place to Buy Crypto?

Yes! As the best crypto exchange in the world, Binance is definitely trustworthy. Its main benefit is the user-friendly design. Even if you’re a complete beginner, it’s quite easy to figure out how buying crypto on Binance works. Moreover, the selection of tokens is excellent, and you can enjoy relatively low trading fees.

What Is the Best Way to Buy Crypto on Binance?

This is quite subjective. We all have our preferences. Nevertheless, Binance claims that most crypto purchases happen via a credit or debit card. That seems to be the most preferred payment method among Binance users. Still, a bank transfer is also an option, and there are more payment methods to choose from. That being said, card transactions are faster than bank transfers. Alternatively, you can also make a deposit and keep a cash balance on your Binance account.

Can You Buy Any Crypto on Binance?

Although Binance doesn’t list every crypto coin in existence, it offers over 60 different cryptos. Unless you’re trying to buy an extremely obscure token, this exchange platform will likely have everything you’re after.

How Do I Buy and Sell Cryptocurrency on Binance?

In this guide, we demonstrated how you could buy cryptocurrency. If you want to buy and sell as part of crypto trading, then you need to head to the spot trading section of Binance. In that case, you will be using Binance just as you would any crypto trading broker.

Is Binance a Crypto Broker?

While you can trade cryptocurrencies on Binance, it’s so much more than a crypto broker. Binance is mainly a crypto exchange, i.e., a place where you can convert one token into another. But if you want to know whether you can trade digital currencies with Binance, the answer is yes. You can do that and more.

Is Binance Legal?

Yes, Binance is a legal, legitimate company. If it wasn’t, it wouldn’t have become one of the most reputable exchanges in the world. That being said, some countries have imposed certain restrictions on it, so its services might not be available to everyone. For example, in the United States, Binance operates as Binance.US. The company has also gotten in hot water over regulation in the UK, Japan, and parts of Canada. This issue seems to stem from debates on how to regulate cryptocurrency in general, rather than irregularities with Binance specifically.

How Do I Deposit in Binance?

If you want to add fiat currency to your account, you have to make a deposit to your Binance wallet. When using Binance from your browser, select Bank Deposit in the Buy Crypto dropdown menu. If you’re using the Binance mobile app, the Deposit option is located in the Overview menu under Wallets. Then, follow the instructions on your screen.

How Do I Sell Crypto on Binance?

If you want to sell crypto coins already in your Binance wallet, the process is quite similar to buying them. Again, you’d need to go to your credit/debit card menu under Buy Crypto (in the app, your card menu is on the home screen). Then use the Sell tab to select which card you want to send your money to and follow the on-screen instructions. It’s essentially the reverse operation of buying crypto.

Conclusion

Over the last five years, Binance has built a reputation as one of the biggest names in the crypto space. With its wide range of services and large crypto portfolio, none of this is surprising.

Today, Binance is one of the best places you can buy crypto from. As we demonstrated in this guide, purchasing crypto coins in Binance is a quick and easy process. And once you have them in your wallet, a whole new realm of possibilities opens up to you. So, where would you go from here?